Pages 93 ratings 100% (1) 1 out of 1 people found this document helpful; Irs 1040 instructions 28% rate gain worksheet pdf download irs 1040 instructions 28% rate gain worksheet pdf read online.

If there is an amount in box 2d, include that amount on line 4 of the 28% rate gain worksheet in these instructions if you complete line 18 of schedule d.

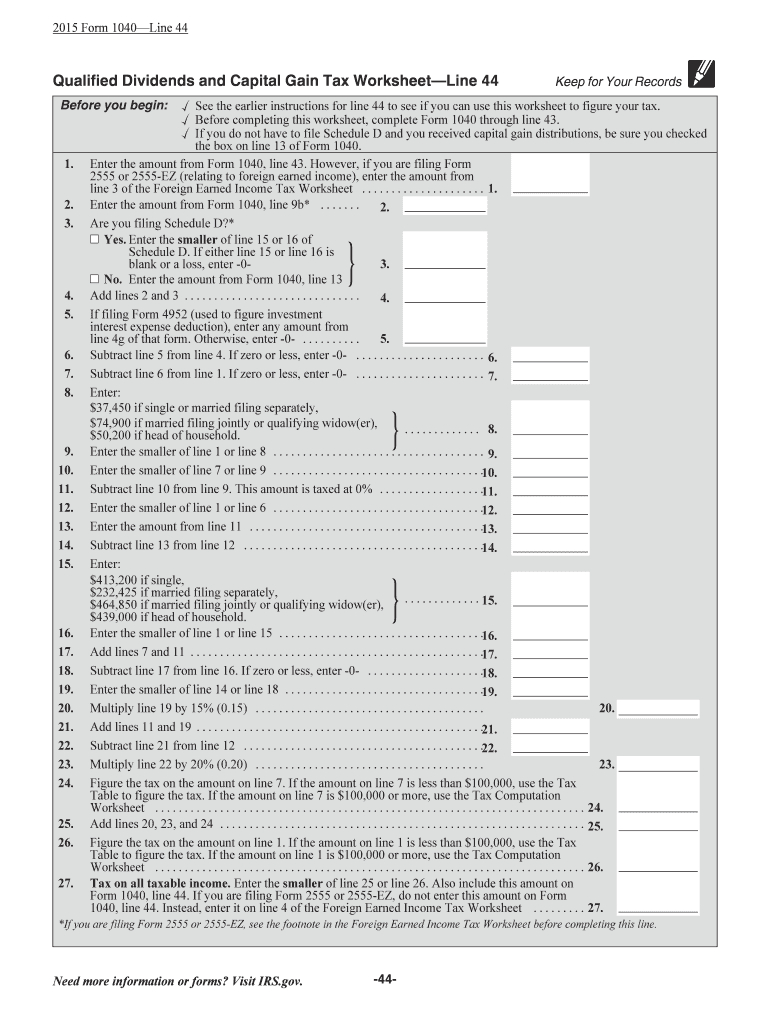

28 rate gain worksheet 2017. Qualified dividends and capital gain tax worksheet 2017. Specifically, the instructions for schedule d have a 28% rate gain worksheet. in a nutshell, you add all sources of collectibles gains, subtract any capital loss carryovers from previous years and subtract any current year short term loss. Per the instructions, the 28% rate will generate if an amount is present on schedule d, lines 18 or 19.

Form 8949 part ii includes a section 1202 exclusion from the eligible gain on qsb stock, or That results in the amount you enter on schedule d line 18 (for tax year 2017, at least). Select a category (column heading) in the drop down.

If the result is a gain, it must be reported on line 13 of the 1040 form. 28 rate gain worksheet 2018n to esign 2015 form schedule d? If the result is a gain, it must be reported on line 13 of the 1040 form.

2017 28% rate gain worksheet—line 18. In taxslayer pro the 28 rate gain worksheet and the unrecaptured section 1250 gain worksheet are produced automatically as needed but there are amounts that may need to be entered on either worksheet by the preparer. Including the capital loss carryover worksheet, 28% rate gain workshee…

The 28 rate gain worksheet is definitely a product that we have not seen before. Fill out this section of the irs schedule d tax worksheet in a similar manner as. Gains, the lower tax ra… part ii:

28 rate gain worksheet 2018. Lacerte calculates the 28% rate on capital gains according to the irs form instructions. Click on column heading to sort the list.

If you checked yes on line 17, complete the 28% rate gain worksheet in these instructions (page 10) if either of the following applies for 20xx: Above a certain threshold — $187,800 for 2017 for most taxpayers — a higher 28. Pin on free templates 2017 instructions for schedule 8812 2017 from schedule d tax worksheet source.

All you need is smooth internet connection and a device to work on. 1) enter the total of all collectibles gain or (loss) from items you reported on form tools for tax pros. You may be able to enter information on forms before saving or printing.

Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Click on the product number in each row to view/download. Mar 12, 2021 — if you have a net capital gain, a lower tax rate may apply to the gain than the tax.

If there is an amount on line 18 from the 28 rate gain worksheet or line 19 from the unrecaptured section 1250 gain worksheet of schedule d according to the irs the tax is calculated on the schedule d tax. Adhere about what to edit to the instructions. If you received capital gain distributions as a nominee (that is, they were paid to you but actually belong to someone else), report on schedule d, line 13, only the amount that belongs to you.

Section 1202 qualified small business stock is taxed at a maximum 28% rate. 28 rate gain worksheet otherwise enter 0 14 15 enter. 1) enter the total of all collectibles gain or (loss) from items you reported on form go to irs.gov/scheduled for instructions and the latest information.

(d) proceeds (sales price) (e) cost This form may be easier to complete if you round off cents to whole dollars. See instructions for how to figure the amounts to enter on the lines below.

You will need to complete the 28% rate gain worksheet in the schedule d instructions. You will need to complete the 28% rate gain worksheet in the schedule d instructions.

Federal Tax Rates For 28 Rate Gain Worksheet 2016

28 Tax Gain Worksheet Worksheet Resume Examples

28 Rate Gain Worksheet 2017 worksSheet list